How to Invest in Real Estate in Nigeria in 2025: The Smarter, Low-Entry Way

If there’s one sector that continues to prove resilient in Nigeria’s unpredictable economy, it’s real estate.

From commercial buildings to short-let apartments, Nigerians, both home and abroad, are increasingly searching for ways to invest smartly and earn consistent returns.

But here’s the challenge: Traditional real estate investments often require tens of millions of Naira, locking out many aspiring investors. However, 2025 is shaping up differently. New, low-entry models are changing how people invest , and one platform leading that change is Zimmr.

Why Real Estate Still Stands Strong in Nigeria’s Economy

Despite inflation, currency fluctuations, and rising living costs, the Nigerian real estate sector remains one of the most stable wealth-building assets.

Key reasons:

- High rental demand: With Nigeria’s population over 220 million, accommodation remains a constant need.

- Urban migration: Cities like Lagos, Abuja, and Port Harcourt continue to attract professionals and business travelers.

- Land value appreciation: Even in semi-urban areas, property values have doubled within 5 years.

In short, real estate is no longer just about buying land, it’s about investing strategically in models that offer strong ROI, low entry cost, and scalability.

Option 1: Zimmr — Affordable Real Estate Investment for Business Travelers

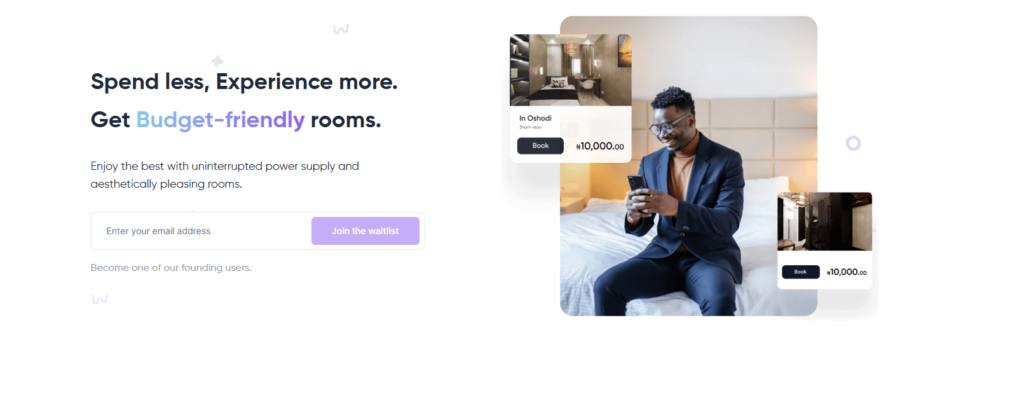

Zimmr is an innovative hospitality-focused real estate project built to serve business travelers across Nigeria. Instead of focusing on residential housing, Zimmr is developing affordable lodging facilities at strategic interstate transport terminals, such as Ojota and Oshodi in Lagos, where thousands of travelers arrive daily.

What makes Zimmr special:

- Affordable investment: Minimum investment starts from ₦1 million, opening the door for middle-income investors.

- High potential ROI: Projected to deliver up to 10x returns in 5 years, driven by steady occupancy rates and expansion.

- Strategic location: Situated near interstate bus terminals that serve 260+ travelers per day.

- Current project: 11-bed facility at Oshodi Terminal, valued at ₦50 million.

- Investment window: Open till January 2026.

- Documents ready: All necessary investor and regulatory documentation are available upon request.

Zimmr’s goal is to own and operate multiple facilities across Lagos and later expand nationwide, combining hospitality, convenience, and property ownership in one seamless model. Imagine owning a stake in a hospitality brand that earns daily revenue from travelers. That’s what Zimmr is building.

Option 2: Co-investment Property Platforms

If you’re not ready to buy a whole property, co-ownership platforms like Coreum, Propseller, and Risevest Real Estate offer partial investments in commercial buildings and short-lets.

Pros:

- Easy entry (from ₦100,000)

- Hands-off management

- Access to multiple properties

Cons:

- Lower ROI margin

- Limited influence on property usage

- Often denominated in dollars, making entry unstable with naira volatility

Option 3: Buy Land and Develop Later

Still a classic, land banking remains a reliable long-term play for those with patience and capital.

- Hotspots: Ibeju-Lekki, Abeokuta, Ibadan outskirts

- Average ROI: 50–120% in 3–5 years

- Capital requirement: ₦2 million and above

However, land banking is long-term and non-liquid, you can’t easily exit your investment when cash is needed. That’s where flexible models like Zimmr stand out.

Option 4: Short-Let Apartment Investment

Short-let apartments exploded between 2020–2023, with investors earning from Airbnb-style bookings.

In 2025, the market is stabilizing, not declining, but it’s getting crowded.

To succeed:

- Choose high-demand areas like Lekki Phase 1, Ikeja, and Victoria Island.

- Have professional management.

- Expect 12–18% annual ROI.

Still, initial investment starts at ₦40–₦60 million for a single apartment, far higher than Zimmr’s ₦1M entry.

Comparing Real Estate Investment Options in Nigeria (2025)

| Investment Options | Minimum Entry | ROI (5 Years) | Liquidity | Risk | Ideal For |

| Zimmr (Hospitality Real Estate) | ₦1,000,000 | Up to 10x | High | Low-Medium | Business-minded investors |

| Co-ownership Platforms | ₦100,000 | 30–50% | Medium | Medium | Business Investors |

| Land Banking | ₦2,000,000+ | 50-120% | Low | Low | Long-term investors |

| Short-let Apartments | ₦40,000,000+ | 60–80% | Medium | Medium-High | High-net-worth investors |

Why Zimmr Stands Out for 2025 Investors

While all the above options have merit, Zimmr’s model aligns perfectly with Nigeria’s current travel and work economy.

Here’s why:

- Daily Demand: Business and interstate travel remains consistent, ensuring daily revenue, not seasonal bookings.

- Strategic Placement: Located near major terminals like Oshodi and Ojota, with guaranteed traffic.

- Low Entry Barrier: Start from ₦1M — accessible to new and mid-level investors.

- Proven Growth Plan: Expansion across multiple Lagos terminals, with prepared documentation and ROI projections.

- Real Impact Investment: Beyond returns, Zimmr supports Nigeria’s tourism and business mobility infrastructure.

How to Get Started with Zimmr

- Request the investment brief: Details on projections, equity structure, and legal documentation.

- Choose your investment tier: Starting from ₦1 million.

- Get verified: Sign investor agreements and complete onboarding.

- Track performance: Receive quarterly performance updates and ROI reports.

To learn more or request the investor kit, visit zimmr.co and the team will call you.

Final Thought: Real Estate in 2025 is About Smarter Entry

If you’re seeking a real estate investment opportunity in Nigeria that can deliver 10x ROI within five years and make a visible difference in how people travel and work, Zimmr should be your first call.